MONEY FLOW DIVERGENCE

This package includes 2 similar daily systems: The MF DIV3 and the MFDD.

Both systems try to detect stocks with high money flow divergence. The premise is that the unwinding of the divergence will result in a breakout.

The main difficulty in designing a money flow divergence systems is to find the exact point of the breakout as divergence can exist for a long period.

Each system uses a different algorithm to detect divergence and trigger trades at the right time in order to minimize drawdown.

The first system (MF DIV3) uses the Relative Strength (RSMK) indicator which filters out weak stocks (relative to the Index) and both systems use volatility indicators in order to block trades during high volatily periods.

The second system (MFDD) uses multiple time frame divergence and takes also into account overall market conditions.

You can purchase the Amibroker or Metastock version by selecting the appropriate tab from the menu at the left.

.

EXAMPLE

The system detected Money flow divergence signals twice on Abiomed (ABMD) in 2022. The first time the stock was up 18% during the next month and the second time it was up 44% after a buyout offer by JNJ.

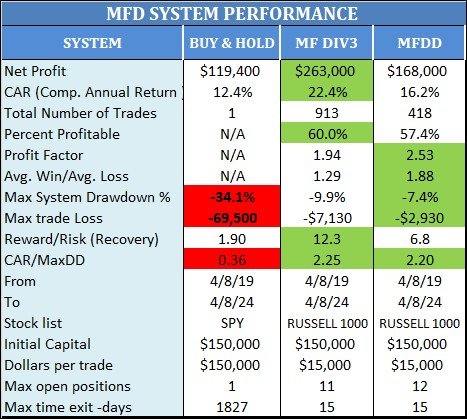

SYSTEM PERFORMANCE

This is how the systems performed during the last 5 year period until the 8th of April 2024.

To produce the test results I used Amibroker Pro with the following test parameters:

Max. Open positions: 11-12

Commissions: $0.01 per share

Volume filter: Limit position to 5% of trading volume

Entry & Exit next day at the open.