BREAK FROM BASE (BFB)

The Break from Base System is designed to detect breakouts from a medium term base (up to 6 months) on expanding volatility which unleashes the potential for dramatic price movement over the next short to intermediate term time periods (usually 2-10 weeks).

BREAK FROM CONSOLIDATION (BFC)

The BFC System is designed to detect possible breakouts from a medium term consolidation (up to 5 months).

Consolidation is common after a stock has been in a lengthy decline or had a significant advance. In other words, the stock is taking a break.

Stocks that are consolidating establish clear support and resistance levels as the bulls and bears fight for control. That may mean institutional investors — who have to buy tens of thousands or more shares to establish their large positions — are quietly buying within a certain price range. That’s how they increase their holdings without significantly driving up their average cost per share. The flat base shakeout is more of a slow grind. The weaker, less committed investors just get worn out by the indecisive, sideways action and eventually lose patience and sell.

The premise of this system is similar to the Break from Base (BFB). The main differences are that it will include stocks forming a wider base and uses my custom money flow indicator to initiate long signals before the breakout anticipating (hopefully) a sudden and very strong (possibly gap) breakout.

The system performs best on stocks in the technology, biotechnology, software and health care sectors. Recent popular groups are Biotech stocks, software, social media etc.

Please note that because the BFB code relies on my custom money flow (volume) indicators to detect breakouts with a high probability of success, if there is no data for volume (as is usually the case with Forex) then the money flow functions will not return a value. Both systems generate only long signals and should be run on daily data.

You can purchase the Amibroker version and the Metastock version here.

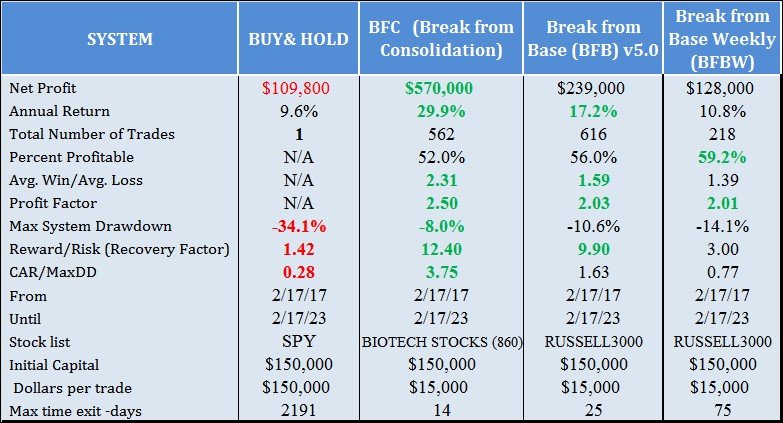

SYSTEM PERFORMANCE

This is how the systems performed during the 6 year period from 2/17/2017 to 2/17/2023.

To produce the test results I used Amibroker Pro with the following test parameters:

Initial trading capital = $150,000

Capital per trade= $15,000 and no margin.

Max. Open positions: 12

Commissions: $0.01 per share

Volume filter: Limit position to 5% of trading volume