RELATIVE STRENGTH

The Relative Strength (RS) method is a popular and useful tool for comparing one investment against the overall market. But few individuals ever manage to use this technique effectively, because they fail to incorporate RS into a comprehensive trading strategy. I used the relative strength concept to develop two strategies: RS for stocks and RS for Exchange traded funds (ETF).

The traditional Relative Strength indicator has a number of deficiencies the most important being that its interpretation is only visible and indicator values are meaningless. To develop the RS systems I used the custom RSMK indicator, which builds on the traditional RS indicator but improves on this important impediment, producing values according to the stock’s relative strength thus making it more useful in trading system design.

BUY THE DIPS (BTD)

This system is similar to the Relative Strength (RS) for stocks. The difference between the two systems is that the RS system looks for stocks that outperform the market whereas the BTD looks for strong stocks in an uptrend and triggers a buy signal during a temporary correction or dip. The basic premise of this system is that a strong growth stock which experiences a small correction will continue an established uptrend. You can see a comparison of both systems at the bottom of the page.

TREND

The Trend package includes 2 systems: The Trend and the Trend with Money Flow (Trend w MF). They both use traditional trend indicators and money flow indicators to look for strong stocks in the early stages of a trend.

All systems are available for the Metastock and Amibroker platforms.

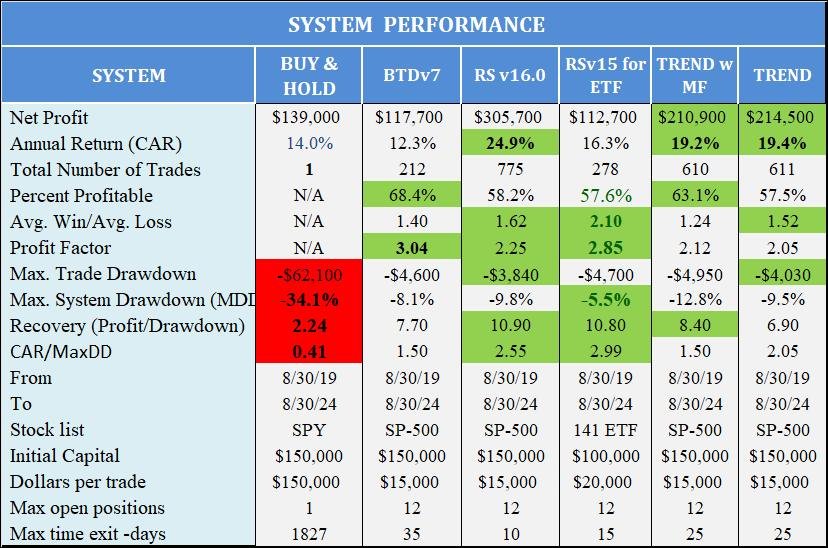

SYSTEM PERFORMANCE

This is how the systems performed during the 5 year period from 2019 to 2024.

To produce the test results I used Amibroker Pro with the following test parameters:

Initial trading capital = $150,000.

Trading amount per stock:$15,000

Commissions: $0.01 per share.

Volume filter: Limit position to 5% of trading volume

Entry & Exit next day at the open.

EXAMPLE

The Relative Strength System (RSv16) produced five trades in 2024 when applied to ZIM Integrated Shipping Services LTD (Symbol: ZIM). Three trades hit the profit target (20%) exit condition while another one (in January) broke even and was closed by the time exit (10 days) and the last one in August was closed by the chandelier stop loss.