Oversold Systems

Oversold strategies are quite popular among traders and there are various technical indicators that can be used to identify overbought and oversold levels. An oversold condition, however, can last for a long time, or the stock can become more oversold triggering a stop loss exit. It is therefore important to use other criteria as well to increase the probability of a rebound.

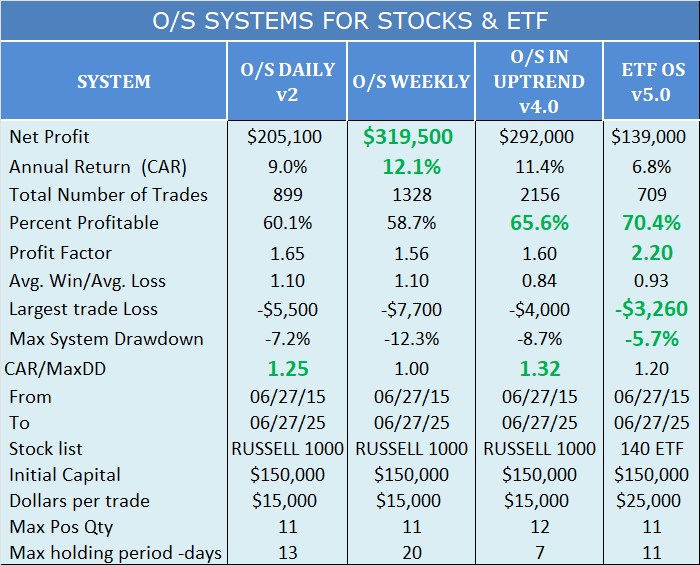

To take advantage of this important concept I have developed two daily and 1 weekly strategy to trade oversold stocks and a different strategy to trade ETF.

These strategies use, except for the classic oversold indicators, and other technical indicators such as money flow, relative strength and volatility in order to identify oversold stocks with a potential for a price bounce.

In the following example you can see that the OS system detected that Shake Shack (SHAK) was oversold 2 times in February-March 2025.