Few things in a trader’s life are more annoying than a trend reversal or a failed breakout. These are so common that a number of trading setups, such as Victor Sperandeo’s 1-2-3 reversal pattern and the 2B rule, have been developed to take advantage of the inability of markets to follow through after breaking out (or down) beyond a previous price extreme.

Writing about the 1-2-3 trend reversal in his second book, Principles Of Professional Speculation, Sperandeo notes that there are three conditions involved in a true change of trend.

- A trendline is broken.

- The stock has stopped making “higher highs in an uptrend, or lower lows in a downtrend.”

- Prices must break out above a previous “minor rally high” in a downward market or below a previous minor selloff low in an upward market.

At the point where all three of these events have occurred, there exists a confirmation of a change of trend.

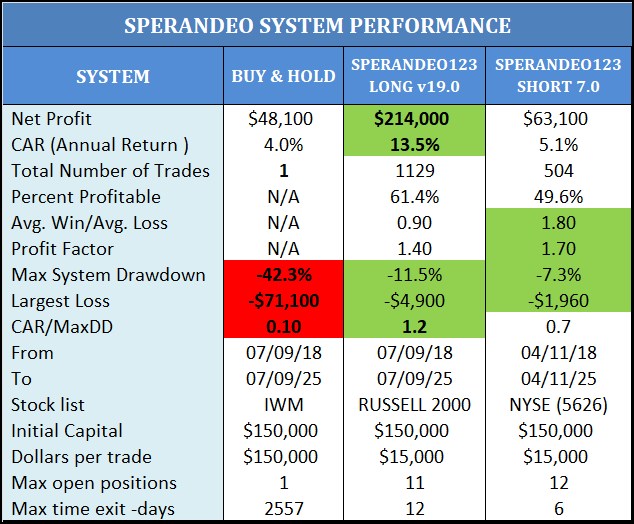

SYSTEM PERFORMANCE

TEST PARAMETERS

The performance of the Sperandeo 1-2-3 Long and Short systems was evaluated over a seven-year period using AmiBroker. The following parameters were applied for the backtest:

Initial trading capital = $150,000

Capital per trade= $15,000 (fixed dollar transactions) and no margin or compounding.

Max. Open positions: 11

Symbols:

- 1-2-3 Long System: Russell 2000 components

- 1-2-3 Short System: All NYSE constituents (5,629 symbols)

Volume filter: Limit position to 5% of trading volume

Note: Backtest results are what you should expect in real time trading and there are no functions (e.g. Peak or trough or zig) that look in the future.