BITCOIN DAILY & INTRADAY STRATEGIES

A key component of these strategies is the use of intermarket analysis. Rather than relying on Bitcoin’s price alone, the systems incorporate the behavior of correlated assets to generate more robust and reliable trading signals.

Historically, Bitcoin was seen as an uncorrelated asset, often compared to “digital gold” as a hedge against inflation and economic uncertainty. However, that relationship has shifted significantly in recent years. Today Bitcoin has become increasingly sensitive to broader risk sentiment, particularly during periods of exuberance or market stress. Drawing on my research published in Technical Analysis of Stocks & Commodities (TASC) and Binance.com, along with updated market observations through 2025-26, these strategies exploit key cross-market relationships to enhance both trend confirmation and timing precision.

Key Bitcoin Correlations

- Technology Stocks (Nasdaq-100):

Bitcoin has shown a strong, consistent positive correlation with the Nasdaq 100, (tracked via the QQQ ETF or NQ futures). Both are often treated as “risk-on” assets, rising during bullish sentiment and falling during market pullbacks.These strategies use the Nasdaq-100 primarily to confirm higher-timeframe (daily) trends in Bitcoin.

- Other Cryptocurrencies (Ethereum):

We’ve found that Ethereum (ETH) is highly correlated, often with greater volatility. This strategy leverages Ethereum’s closer relationship to verify short-term daily and Intraday signals.

This package includes six highly adaptable, modular trading strategies designed for various (bullish and bearish) market environments .

What’s Included

- Four Daily Strategies for:

- Bitcoin (BTCUSD)

- Ethereum (ETHUSD)

- iShares Bitcoin Trust ETF (IBIT)

- Grayscale Ethereum Trust ETF (ETHE)

- Two Intraday (15-minute) Strategies for:

- IBIT

- ETHE

The strategies are not password-protected, allowing full transparency and easy customization. They combine non-correlated entry signals with diversified exit techniques, enabling them to adapt to both trending and range-bound markets.

All strategies are available for both TradeStation and MultiCharts platforms.

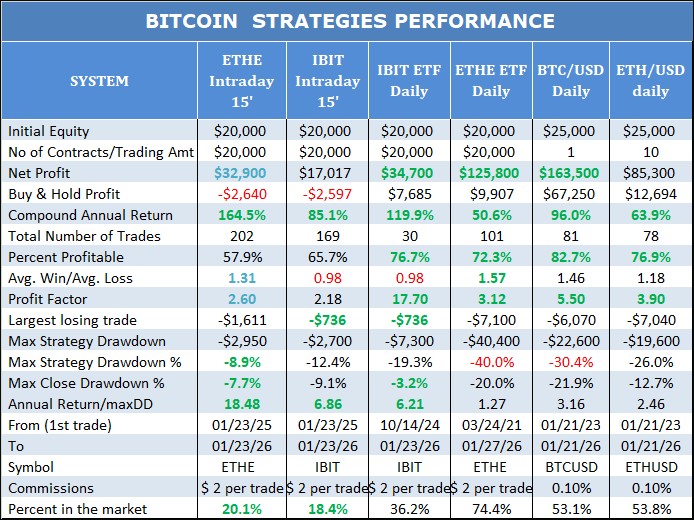

Below, you can see the performance of the strategies when applied to BTC/USD, ETH/USD, IBIT and ETHE.

Pricing & Order Information

The total price for the complete strategy package is $290 .

This all-inclusive package includes six fully customizable trading strategies covering both daily and intraday timeframes for Bitcoin, Ethereum, and crypto-linked ETFs, along with the manuals and one full year of technical support and strategy updates.

How to Order

To place your order, simply email markos.katsanos@gmail.com and include:

- Your preferred platform (TradeStation or MultiCharts)

- Your preferred payment currency (USD or EUR)

- Please include “Bitcoin Order” in the email subject line

Once your email is received, you’ll be sent a PayPal payment request and the appropriate strategy package shortly thereafter.

✔ No subscriptions

✔ No hidden fees

✔ Immediate access after payment

Note: A PayPal account is not required — you can also complete the purchase using your credit card.

You can see above the out of sample (OOS) performance of the daily & intraday strategies applied on BTC, ETH, IBIT and ETHE.

Note: The performance of BTC and ETH may vary according to your data provider as Bitcoin trades on multiple exchanges simultaneously. For the current performance report we used data for BTCUDT and ETHUSDT from Binance.com .