Money Flow Divergence Systems: Unlocking Hidden Opportunities

Identifying true market opportunities often means looking beyond simple price action. Our Money Flow Divergence (MFD) systems are meticulously designed to do just that – detecting powerful underlying forces that signal impending price breakouts.

This comprehensive package includes:

- Two Daily Systems: MF DIV3 and MFDD

- One Weekly System: MFDW

The Core Concept: Unwinding Divergence for Breakouts

At the heart of all our MFD systems is the principle of money flow divergence. This occurs when a stock’s price trend diverges from its underlying money flow, indicating a build-up of pressure that often precedes a significant move. The fundamental premise is simple: the eventual “unwinding” of this divergence leads to a strong price breakout.

The real challenge in divergence trading lies in pinpointing the precise moment the breakout will occur, as divergences can persist for extended periods. Our systems tackle this by employing unique, sophisticated algorithms to detect divergence and trigger trades at the optimal time, aiming to minimize drawdown and maximize timely entry.

Each system uses distinct algorithms to detect money flow divergence and pinpoint optimal breakout entry points, minimizing drawdown and avoiding prolonged divergence periods.

- MF DIV3 (Daily): Employs my custom Relative Strength Indicator to filter out stocks underperforming the market index and it integrates volatility indicators to block trades during high-volatility periods, ensuring more reliable signals.

- MFDD (Daily): Utilizes multiple time-frame divergence analysis and considers broader market conditions to enhance breakout timing accuracy.

- MFDW (Weekly): Focuses on weekly data to capture longer-term divergence patterns, ideal for traders with extended time horizons.

The systems are available for the Metastock and Amibroker platforms. You can purchase the appropriate system for your platform by clicking on the appropriate tab at the left.

EXAMPLE

The system detected Money flow divergence signals twice on GE Vernova (GEV) in Sept 2024 and January 2025.

Both times the stock hit the profit target.

SYSTEM PERFORMANCE

Backtesting Results

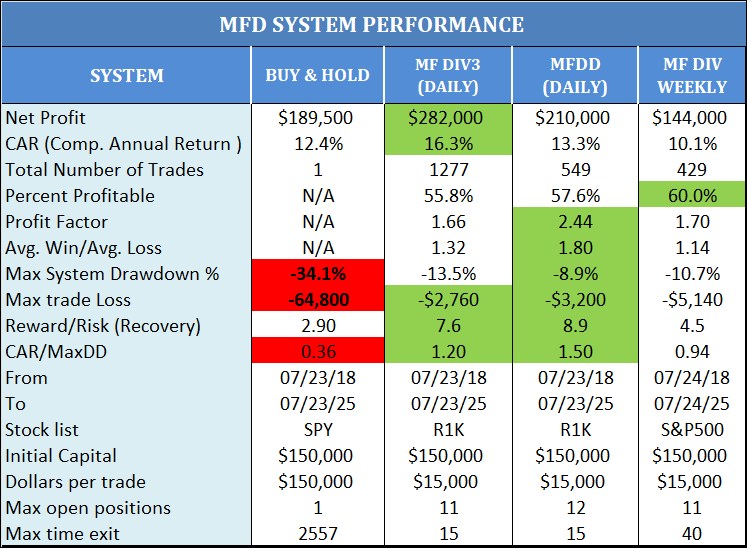

We believe in transparency. Here’s how our MFD systems performed during the 7-year backtest period, concluded on July 23rd, 2025. These results were generated using AmiBroker Pro with the following parameters:

- Maximum Open Positions: 11-12

- Trading Amount Per Position: $15,000 (fixed, no margin or compounding of profits during trades)

- Volume Filter: Position size limited to 5% of the daily trading volume to ensure liquidity.

- Entry & Exit: Executed at the open of the next trading day.

(Detailed performance reports and equity curves for each system are available on request.)