The systems presented below combine relative strength, trend-following, and custom money flow indicators to optimize trading decisions. Designed for robust performance, these systems are particularly effective on large-cap stocks (e.g., S&P 500 or Russell 1000 components). All systems are readily available for the Metastock and Amibroker platforms.

Below is an overview of our three core systems: Relative Strength (RS), Buy The Dip (BTD), and Trend.

RELATIVE STRENGTH

The Relative Strength (RS) System compares a stock or ETF’s performance against the broader market, enhancing the traditional Relative Strength indicator with my custom RSMK indicator. Unlike the standard RS indicator, which lacks interpretable values, RSMK quantifies relative strength, making it a powerful tool for trading system design. I used the relative strength concept to develop two strategies: RS for stocks and RS for Exchange traded funds (ETF).

- RS for Stocks: Identifies stocks outperforming the market, ideal for capturing sustained upward momentum.

- RS for ETFs: Targets ETFs with strong relative performance, suitable for diversified market exposure.

.

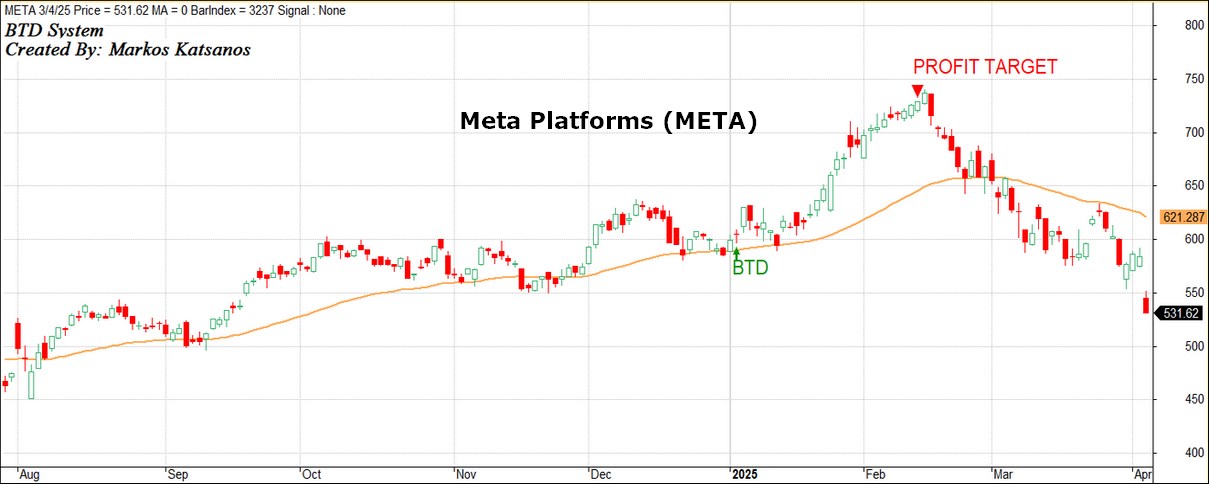

BUY THE DIPS (BTD)

The BTD System focuses on strong growth stocks in an established uptrend, generating buy signals during temporary corrections (dips). Unlike the RS System, which seeks consistent outperformance, BTD capitalizes on short-term pullbacks in high-momentum stocks, anticipating a continuation of the uptrend. A detailed comparison of the RS for Stocks and BTD systems can be found below.

TREND

The Trend system combines traditional trend analysis with my custom money flow indicators (VFI and FVE) for enhanced signal confirmation, to look for strong stocks in the early stages of a trend.

All systems in this package perform best on large cap stocks (e.g S&P 500 or Russell 1000 components)

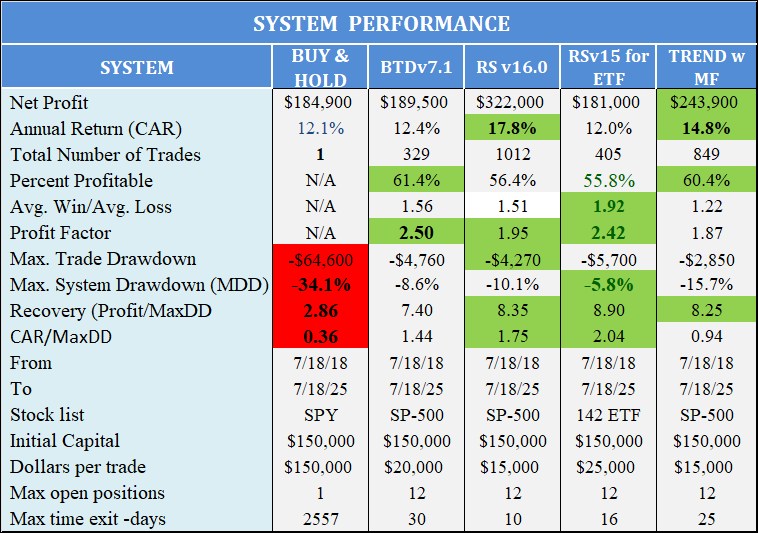

SYSTEM PERFORMANCE

The systems were tested over a seven-year period (2018–2025) using AmiBroker Pro with the following parameters:

- Initial Trading Capital: $150,000

- Trading Amount per Stock: $15,000 (fixed, no margin or reinvestment)

- Entry & Exit: Next day at the open

EXAMPLE

On April 17, 2025, the Relative Strength System (RSv16) identified Netflix (NFLX) exhibiting exceptional relative strength. This led to a signal that resulted in a 20% profit, hitting its target exit on May 2, 2025.

The BTD system effectively detected a strategic opportunity in Meta Platforms (META) on January 3, 2025, as it underwent a temporary dip during an uptrend. This resulted in a profitable trade that yielded 22%, reaching its target exit by February 14, 2025