The VPN System and Volume Surge System are designed to detect high-probability breakouts in stocks, leveraging custom money flow indicators to identify strong price movements driven by increased volume and expanding volatility. Both systems are optimized for daily charts and perform best on small- and mid-cap stocks, particularly in sectors like technology, healthcare, AI, cloud software, social media, and Bitcoin.

Volume Surge System

Is there anything more satisfying for a trader than capturing a huge breakout?. Looking at hundreds of charts for a high volume breakout pattern can be tedious and time consuming but with this system you can scan more than 5000 stocks in seconds.

The Volume Surge System is designed to identify significant breakouts, including potential gap moves, by scanning thousands of stocks in seconds. It uses custom money flow indicators—Finite Volume Elements (FVE), and Volume Flow Indicator (VFI)—to filter out low-probability breakouts, focusing on those driven by high volume.

VPN System

The VPN System is based on the custom Volume Positive Negative (VPN) Indicator, introduced in the April 2021 issue of Technical Analysis of Stocks & Commodities.

The VPN Indicator compares volume on up days versus down days to signal bullish momentum.

Unlike the basic system presented in the article, this version incorporates additional volatility and technical criteria to filter breakouts with a high likelihood of success.

The VPN and Volume Surge system performs best on small and medium cap stocks and should be applied on daily charts. You can purchase the Amibroker or Metastock versions by selecting the appropriate tab from the menu at the left.

EXAMPLE

You can see here that in the case of Aurora Cannabis (ACB) the system detected a high volume breakout on 4/2/24. The stock was up 44% the next day .

VPN & VOLUME SURGE PERFORMANCE

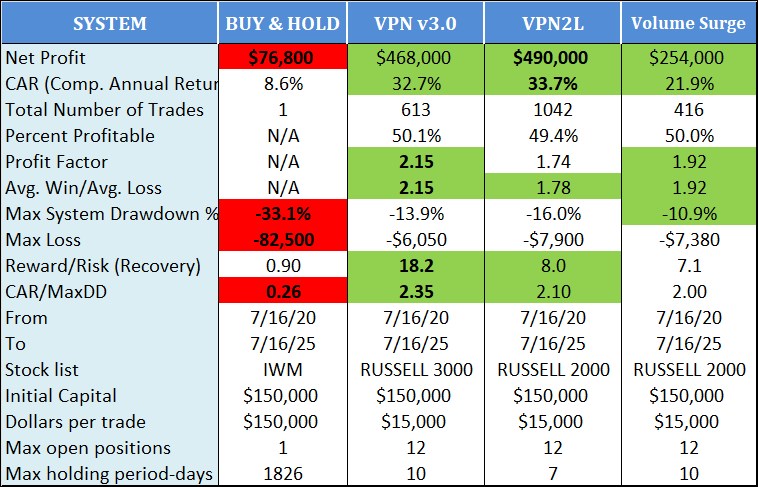

This is how the systems performed during the latest 5 year period until July 16, 2025.

To produce the test results I used Amibroker Pro with the following test parameters:

Initial trading capital = $150,000

Capital per trade= $15,000 (fixed dollar transactions) and no margin or compounding.

Max. Open positions: 12.

Volume filter: Limit position to 5% of trading volume

Commissions: .5 c per share